Professional services firms are always looking for new ways to gain a competitive advantage—but they don’t always know where to start. Brand research can provide answers and a clear path forward.

In our work with clients, we see a professional services marketplace with lots of competition and very little differentiation. Many firms claim distinction, but they aren’t able to demonstrate true difference. In fact, most firms rely on “same story” differentiators. As a result, they all sound pretty much alike.

These firms talk about their “great people,” “exceptional service“ and how they are “trusted advisors.” Maybe you’ve used the same language — and maybe those claims are even true. But today’s buyers hear them so often, and they are so difficult to validate until a client has been through an actual engagement, that they’ve lost any power to persuade.

How can you avoid undifferentiated messages like these and really, truly stand out from the competition? The answer lies in brand research. Below, we’ll explore some of the most common questions about brand research and how it can help firms like yours get ahead.

What is Brand Research?

Brand research is the process of collecting and analyzing data on your firm’s reputation, visibility and marketplace to understand how your business is perceived today and how it can build a powerful, differentiated brand in the future. Brand research uncovers the characteristics that truly set you apart from key competitors in the eyes of your prospective clients. These characteristics are commonly known as differentiators or your competitive advantage.

To fully understand the implications of this definition, we first have to nail down the concept of your firm’s brand. Your brand is the product of your reputation and your visibility. If you have a great reputation for specific expertise and high visibility within your target audience you have a strong brand.

Here’s another way to think about a brand: It’s the way in which people in your target audience perceive your firm. Have they heard of you? And when they think of you, what comes to mind?

What is the Impact of Brand Research?

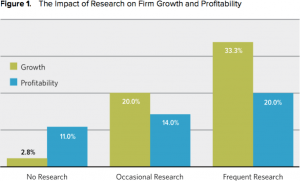

Studies show that firms that conduct brand research grow faster and are more profitable than firms that do not.

Figure 1 shows that even occasional research has an impact. More frequent research produces a bigger impact.

Why? Research gives firms an evidence-based foundation on which to build a solid strategy — including data-driven brand positioning and messaging.

Often, major decisions about a firm’s messaging and business direction are based on guesswork or assumptions. That can be very risky. Do you base decisions on suppositions like these?

- “This is probably a message our audience will respond to.”

- “I think this is a service our clients would appreciate.”

By conducting research, you equip yourself with evidence so you know that you are on the right track. And that certainty can save you a lot of pain and effort down the line. Brand research can give you solid answers to questions you were guessing at before—for instance, what differentiators matter most to your clients or which services they would most like to see you offer.

There is another major benefit that many firms overlook. In the absence of solid data, everyone feels free to have an opinion. If your leadership team isn’t in complete agreement about the direction your firm should take, research can provide objective guidance and get everyone in alignment. When facts replace opinion it’s easier to achieve a consensus.

When Should You Use Brand Research?

There are a number of junctures at which a firm would be well advised to conduct brand research. Here are ten common examples of situations when brand research can provide powerful insights.

Top 10 Examples of Brand Research Scenarios

- Following a merger or major acquisition

- When launching a new practice or service line

- When growth has stalled

- When facing powerful new competitors

- When experiencing downward pricing pressure

- When your target audience has changed

- When considering a new name or identity

- When your visual brand or messaging has become dated or no longer reflects your firm

- When you need to attract top talent

- When your professionals don’t know how to describe your firm

Some of these are the big moments in the life of a firm. These are the pivotal periods when a firm stakes out a new identity or a new path for the future. They typically involve major decisions with major consequences. As such, they are opportune times to guide the path forward with data.

But research isn’t just for moments of big, disruptive change. You may simply find that you have outgrown your old brand. What once differentiated you no longer embodies the value that you provide to clients. This will happen many times in the life of most firms, and research helps you rebrand to communicate who you really are today.

Similarly, when you decide you want to accelerate growth and gain a competitive advantage, research gives you the knowledge you need to get there efficiently.

What Can You Learn From Brand Research?

As it turns out, you can learn a lot. Common research topics range from how the marketplace views your firm to who your true competitors are and how you differ from them. In short, you can gain insight into the entire client journey.

Below are examples of insightful brand research questions you might ask your audience.

Top Brand Research Questions

- What are your target clients’ priorities?

- How do you fit in?

- How is your firm perceived in the marketplace?

- Who are your true competitors?

- How do you compare to your top competitors?

- How do your best prospects search for a firm like yours?

- What are they most interested in?

- What turns them off?

- What tips the scale during the final selection process?

- How well does your firm deliver on its promises?

- What do your clients value most about your firm?

- How loyal are your current clients likely to be?

- What is your potential for more referrals?

- What other services do your current clients want you to offer?

Answers to questions like these usually uncover some surprises. You may discover hidden competitors you hadn’t known about. You may also learn that your clients value traits in your company that you had never appreciated before — traits that might make good differentiators.

Likewise, you can study your firm’s strengths, weaknesses and the reasons clients choose you — all of which may inform your firm’s differentiation and positioning.

You may think you know the answers to these questions already. But after conducting research, most firms find significant gaps between what they think they know about their audience and the facts on the ground. These blind spots can have major negative consequences. They result in wasted marketing budget and effort. Your hard work will not produce the results you seek. Assessing these perception gaps is another important function of research, helping you check your assumptions and evolve your internal views of the marketplace.

What Are the Major Brand Research Methods?

There are four research methods that professional services firms use most often. But it’s important to note that only two of the four are effective and practical.

- Informal or unstructured interviews. Probably the most common type of research used by professional services firms, this involves interviewing or having conversations with clients without performing any formal scoring or analysis. These interviews are often carried out by internal team members. While well-meaning, this informal approach is rarely useful. Respondents are often highly guarded, producing misleading — or outright incorrect — conclusions. Evidence is anecdotal at best.

- Focus groups. Focus groups can work well for consumer products, but they are not very effective in the B2B world. The reason is simple: Clients are reluctant to reveal any significant information to a group of competitors. Equally problematic, assembling a useful focus group in the professional services world can be expensive and a logistic challenge. Focus groups are rarely the right choice for professional services firms.

- Online surveys. Online surveys can be effective, as long as they are produced by people who have deep experience with the relevant audiences. It takes experience to craft questions that produce useful and actionable information. As long as your research team understands your industry and is seen by respondents as impartial, online surveys can be an affordable way to reach a geographically diverse audience with a degree of anonymity that will reassure respondents and encourage more accurate answers. But be cautious, the kinds of questions and research protocols that work for B2C audiences often fall flat in the professional services world.

- Structured interviews. While relatively expensive, live interviews, typically conducted by phone, offer a number of advantages. Because they are structured, the data can be subjected to sophisticated analyses and generate powerful insights. And because they are relatively personal, a skilled interviewer can pick up indirect information — such as emotions and nuances in a participant’s language — making note of those details and scoring appropriately. Structured interviews can be used in conjunction with surveys to provide multiple angles of insight. Again, an impartial researcher reinforces the confidentiality of the person’s answers and encourages more candid responses.

Selecting the appropriate research method can mean the difference between a useful, productive study and one that falls short of your goals.

How Can You Turn Brand Research into Growth?

Research will help you better understand your firm’s strengths, weaknesses, current opportunities and emerging threats. With this detailed, multidimensional picture of your firm and its place in the market, you can then proceed to develop an informed strategy.

It’s useful to document your brand strategy — your true differentiators and the positioning you will adopt moving forward — in three related areas.

- Differentiators—This is a simple list of individual differentiators that set your firm apart from your competitors. Some of these differentiators may be decisions that you make to do things differently. For example, specializing in an industry. Others may be characteristics of your firm that you discover during the course of your brand research.

- Positioning Statement—A positioning statement is a short paragraph that describes what your firm does, who it does it for (your target clients) and why they select you over your competitors. It describes how you are positioned in a competitive marketplace and serves as the DNA of your go-to-market strategy. Writing a positioning statement forces you to look at your firm in relation to the rest of the marketplace.

- Messaging Architecture—Your messaging architecture identifies your primary audiences (for example, potential clients, referral sources and prospective employees) and what messages each needs to read or hear to persuade them that your firm is the best choice. Each of these messages must be consistent with your overall brand positioning. The document may also identify common objections and concerns you will encounter from each audience and outline the arguments you can use to counter them. This is a very useful document when you are developing promotional materials or pulling together a proposal.

These are living documents—you should update them as conditions change—that your team can mine for key messages as you reach out to existing and new audiences.

This is also the stage at which you will begin to really drive growth, as you translate your new, differentiated messaging into the materials that communicate your brand. These materials can take many forms, from your logo, tagline and brand identity guidelines to your website, marketing collateral and pitch decks.

Brand research also serves another important function. It can help your entire team talk about your firm in a coherent way and make your business development efforts more consistent. Nothing persuades technically oriented people like objective research data. Replacing opinions with facts ends many unproductive debates.

Using Research as Content

Speaking of persuasion, there is one more important role that brand research can play. Research is the one of the most credible and trusted types of thought leadership content. It can help establish you and your firm as a dependable source of insights and industry knowledge.

As an example of how your brand research can become premium thought leadership content, let’s say that as part of your study you uncovered the top emerging threats facing your target audience’s industry. Obviously, this helps you better target your messaging and train your business development team. That’s two solid wins right there. But why stop there?

This same research result can also become the centerpiece of a research report on emerging threats facing your targeted industry. As a piece of premium content, a research study immediately establishes you as an authority on your target industry. While not every piece of brand research is suitable for use as premium content, this triple-use scenario is not uncommon. We have seen it succeed with many clients.

How to Conduct Brand Research

Brand research is most effective when conducted by a qualified third party. Look for a research firm that has extensive experience working with B2B clients. If you can, find one that knows your industry. Ask to see examples of prior research to determine if the data they collect is easy to understand and actionable.

You will need to supply names, phone numbers and email addresses of the individuals you want them to contact. To ensure they agree to participate you will want to reach out to each person ahead of time. A qualified research firm can guide you in this outreach. When selecting participants, try to include people with a wide range of perspectives, include some who may have negative impressions of your firm.

The research firm will work with you to develop a set of research questions. Once those are agreed upon and the participants identified, they will get to work. The firm will conduct the interviews and distribute the survey instruments. They will score the responses and analyze the results. Finally, the firm will present the data to you, usually live so that they can answer any questions you have. A presentation should also include a clear set of recommendations based on the findings.

Can You Do the Research Yourself?

While it is possible to conduct research internally, you need to be aware of its limitations.

First, clients will be less inclined to provide honest answers to an employee of your firm. They may not want to hurt your feelings, they may worry that their answers will not be kept confidential, or they may not want to jeopardize a good relationship. You can mitigate these concerns somewhat by hiring a contractor to conduct the interviews, but if that person will be sharing the raw data with your team that may not always be enough to instill confidence.

Second, unless you are experience in survey design, you can easily introduce bias into your questions, producing answers that are misleading.

Third, data analysis can be complex. For example, how you categorize and roll up responses can dramatically affect the final charts.

Finally, there’s nothing like an outsider delivering the findings. Internal teams are easily dismissed by leadership. Outside experts, however, bring an imprimatur of authority and wisdom.

A Final Thought

Brand research gives you the tools you need to put your firm on a path to fact-driven growth and profitability — and to forge ironclad competitive differentiators. In a field of “same story” messages, a little research can make all the difference.

As you spread your research-driven messages, each highly targeted and relevant to your audience, you will find your marketing efforts connect with more potential clients. If you are like many firms that follow this path, you’ll enjoy wider visibility, a growing reputation and faster growth.

How Hinge Can Help

For professional services firms that wish to accelerate growth or update their brands, success is within reach. Hinge is the leader in brand research services for professional services firms. With over 16,000 firms in our database we can benchmark you against your competitors and offer unparalleled actionable insights. Check out our industry-leading, research-based services or call us today: 703-391-8870.

Additional Resources

- Our Professional Services Guide to Research will show you how to use research to build a smarter, more competitive firm.

- To understand how your buyers think and why they choose one professional services firm over another, check out our research report, Inside the Buyer’s Brain.

- Do you need to learn specific marketing skills? Or are you looking to bring data-driven marketing to your firm? Hinge University offers everything from step-by-step how-tos to in-depth courses — at a very affordable price.