It’s no surprise that marketing is top-of-mind for many firms in the accounting and financial services industry. Our recent research has shown that attracting and developing new clients is the number one strategic priority for a wide majority of accounting and finance firms, cited by over 70% of respondents.

But as firms set out to generate new business, what are the top marketing initiatives on their agenda? What specific steps are they taking this year to bring in new leads – and ultimately, to grow?

The Top 5 Business Challenges

At the Hinge Research Institute, we decided to get to the bottom of these questions in our research, as part of our ongoing studies of professional services firms and how they grow. We surveyed 530 professional services firms, covering all industries and firm sizes. Respondents were primarily owners or operations and marketing executives.

From this dataset, we were able to drill down further and examine how accounting and financial services firms specifically are prioritizing their marketing efforts. These organization’s top five marketing initiatives reveal some key lessons about how firms are striving to compete today.

1. Try to Generate More Referrals

Referrals have long and widely been viewed as the best and the easiest way to generate new clients. Cited by an impressive 50% of respondents, the top standing of referral generation wasn’t a surprise. It also underlined the importance of a comprehensive referral strategy.

Our past research shows that referrals are indeed very important. But when firms seek to generate referrals, they often focus on existing clients and known referrers – to the exclusion of other referral sources. In fact, many referrals come from people who know your firm by reputation or expertise.

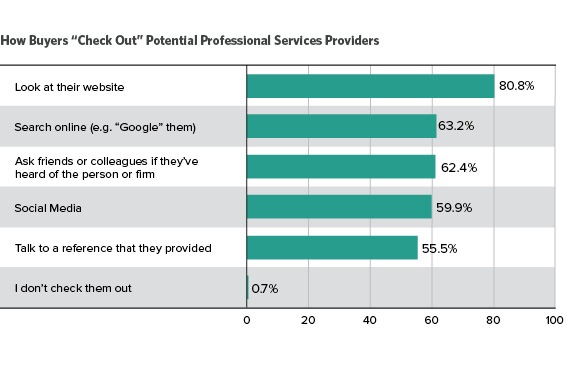

Don’t forget that the vast majority of referrals check you out online before contacting you.

If you’re not easy to find across major marketing channels, you may be quickly ruled out of consideration. It’s important not to let referrals go to waste by failing to give them adequate marketing support.

2. Increase the Visibility of Your Experts

Increasing the visibility of the firm’s experts was cited by 43% of participants in the study. This high ranking, too, is to be expected – precisely because it is so effective.

By promoting experts within the firm, businesses can benefit from a “halo effect,” where well-respected and highly visible professionals transfer their positive reputation to their firms.

Additionally, Visible Experts confer a variety of proven benefits to their organizations, including:

- Higher billing rates

- Improved ease of closing deals

- Stronger professional partnerships

Implementing a Visible Expert program can help accounting and financial services firms take advantage of these benefits.

For individual consultants and small firms, this might mean focusing on one person or a handful of individuals. Larger firms should consider establishing an ongoing program to help develop future experts and practice leaders.

3. Make Existing Clients More Aware of the Services You Offer

40% of respondents in our study reported that a top priority was making existing clients more aware of the services they offered. This can be a critical effort for getting the most out of existing relationships and generating new business.

In previous research, we’ve found that clients often express that they wished providers offered a service that they already offer.

For individual consultants and smaller firms, this kind of confusion can be surprisingly simple to fix. Make a concerted effort to clarify the services you offer across all of your marketing channels, focusing particularly on your website.

Larger firms should consider establishing a program to help client-facing staff become more proactive in educating clients and making internal referrals.

4. Increase the Visibility of Your Firm’s Brand

Increasing the visibility of a firm’s brand helps with referrals and makes it easier to close new business. So it makes sense that this was a priority for 38% of firms in our survey.

Brand visibility should include attention to both you reputation and visibility. Key priorities in any brand building effort include:

- Content marketing: Share your expertise and help potential clients through educational blog posts, ebooks, webinars, and more.

- Social media: Share your content, network with industry influencers, and lead ongoing industry conversations on platforms like LinkedIn, Twitter, and Facebook.

- Professional partnerships: Build credibility and crucial connections by developing industry partnerships. With your partners, you might conduct research, deliver webinars, or produce content to benefit audiences in your industry.

By building your brand across multiple marketing channels, you can give your firm the visibility it needs to generate sustained growth.

5. A Content Marketing Program

Implementing or continuing a content marketing program is a top priority for over 38% of respondents. Content is one of the most important ways that potential clients check you out – and it provides crucial support for your reputation and expertise.

When firms convey the knowledge of their experts through educational content, potential clients have an easy way to assess whether the provider can help them.

Ultimately, content marketing is about educating and qualifying new clients. It establishes the expert brand of your firm and Visible Experts, generating new opportunities along the way.

Marketing is a key business driver for accounting and financial services firms. The reality of the marketplace is that client needs, buying behaviors, and expectations are rapidly evolving, and firms’ marketing efforts must evolve along with them.

If firms can stay ahead of the curve and balance their marketing efforts successfully, they can position themselves for continuing growth.

See the full research and download 2015 Professional Services Marketing Priorities Report below.

On Twitter+ or LinkedIn? Follow us @HingeMarketing and join us on LinkedIn.