“Our business was built on relationships and referrals.”

I hear this all the time from professional service providers. But that’s not a sustainable growth strategy in today’s marketplace…and the research backs that up.

Companies today face new challenges. A talent shortage will make recruiting and retention difficult. Technology and automation will reshape the skills needed in marketing departments. And only the most proactive companies will keep up with swift changes in buyer behavior.

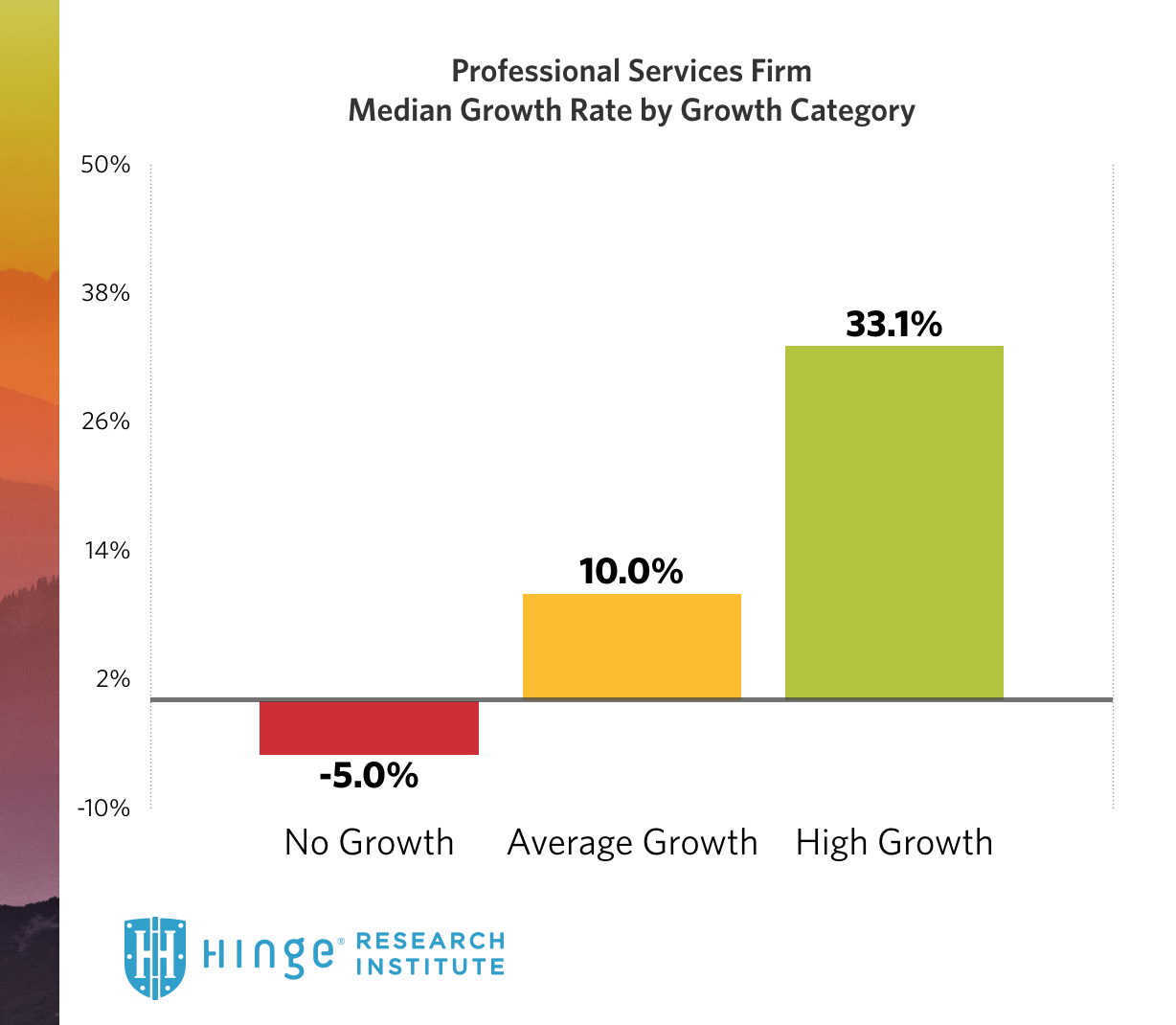

For the fifth consecutive year, the Hinge Research Institute conducted a comprehensive study of over 1,000 businesses providing professional services. Part of our analysis was to look at what “high-growth” firms (at least 20% compound annual growth over three years) do differently than firms who are not growing at all.

These exceptional companies were able to grow 3X faster than average. As if that wasn’t enough, High-Growth firms were twice as likely to be highly profitable.

What sets these companies apart? What strategies do they use to drive growth? Can you copy their success?

This article aims to answer these questions and more.

Five business growth strategies used by the fastest-growing firms

Strategy #1 — Become a “digital disruptor”

Adoption of digital & content marketing techniques is up dramatically over the past three years. About half of study participants reported publishing blog posts, networking on social media and doing some level of email marketing.

All of these marketing activities are great, but they’re only enough to match what others are doing. By themselves, they’re not enough to drive extraordinary growth.

In a podcast interview with David C. Baker, author of “The Business of Expertise,” David spoke about the power of giving away “generalized” expertise for free, which will attract opportunities to charge for your “applied” expertise.

Tune to the 13:36 minute mark to hear David speak about the importance of ‘Visible Expertise’

High-Growth companies go the extra mile and invest more effort towards creating high-value, high-quality content. Case studies, downloadable gated content, podcasts and primary research reports are great examples. These channels can be effective ways to package a firm’s “generalized” expertise for buyers to consume in their preferred format.

Digital & content marketing allows firms to scale their expertise and drive more online leads.

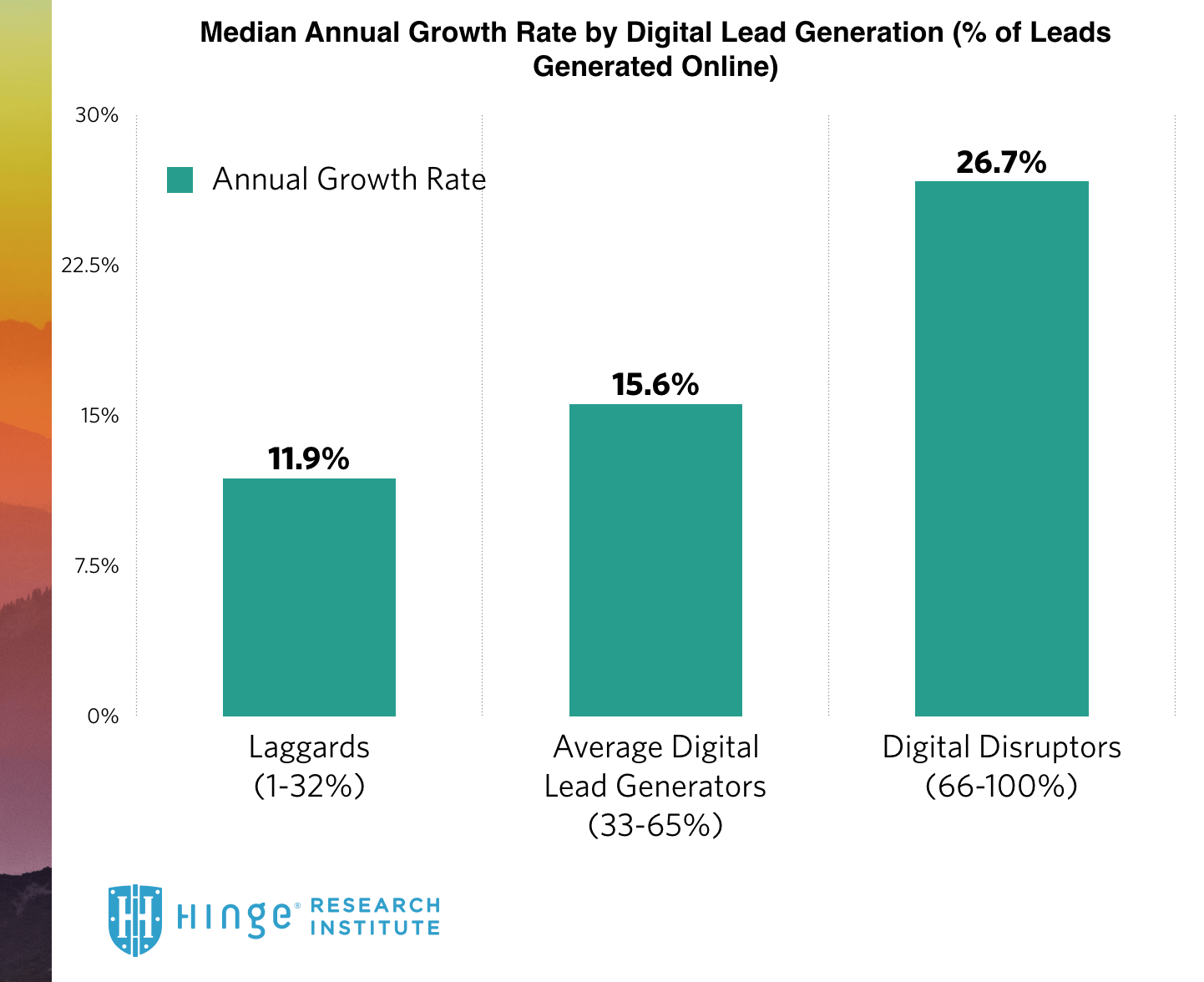

In the book Online Marketing for Professional Services we first noticed a relationship between annual growth rates and the number of leads a company generates online.

We found that relationship to remain true today. In our 2020 study, firms that generated a majority (66% or more) of leads from online sources grew 2x faster than firms that generated low levels of online leads.

As expected, these “Digital Disruptors” generated 27% more marketing impact from any given digital or content marketing technique in their mix. In particular, they generated 60% more impact from podcasts, 50% more impact from video, and 40% more impact from publishing guest blogs, suggesting strong speaking, writing and networking skills.

In the coming decade, professional services firms will need to embrace this digital transformation as part of their business growth strategies. They will need to explore a wider range of digital channels such as video, podcasting, and research as content. The most successful of them will likely be testing promising new technologies and techniques, as well.

Strategy #2 — Research your target markets frequently

High-Growth firms are less concerned about future threats like changes in buyer behavior and unpredictability in the marketplace. Why? They do research frequently.

Daniel Burrus, author of the book “The Anticipatory Organization” and one of the world’s leading futurist speakers on global trends and disruptive innovation, was also a guest on “The Visible Expert” podcast. Daniel contends that for organizations to truly grow and thrive, it is imperative to anticipate problems before they happen. This can be done by frequently researching and analyzing target markets and internal business data.

Tune to the 26:10 minute mark to hear Daniel’s thoughts on planning and anticipating problems before they happen.

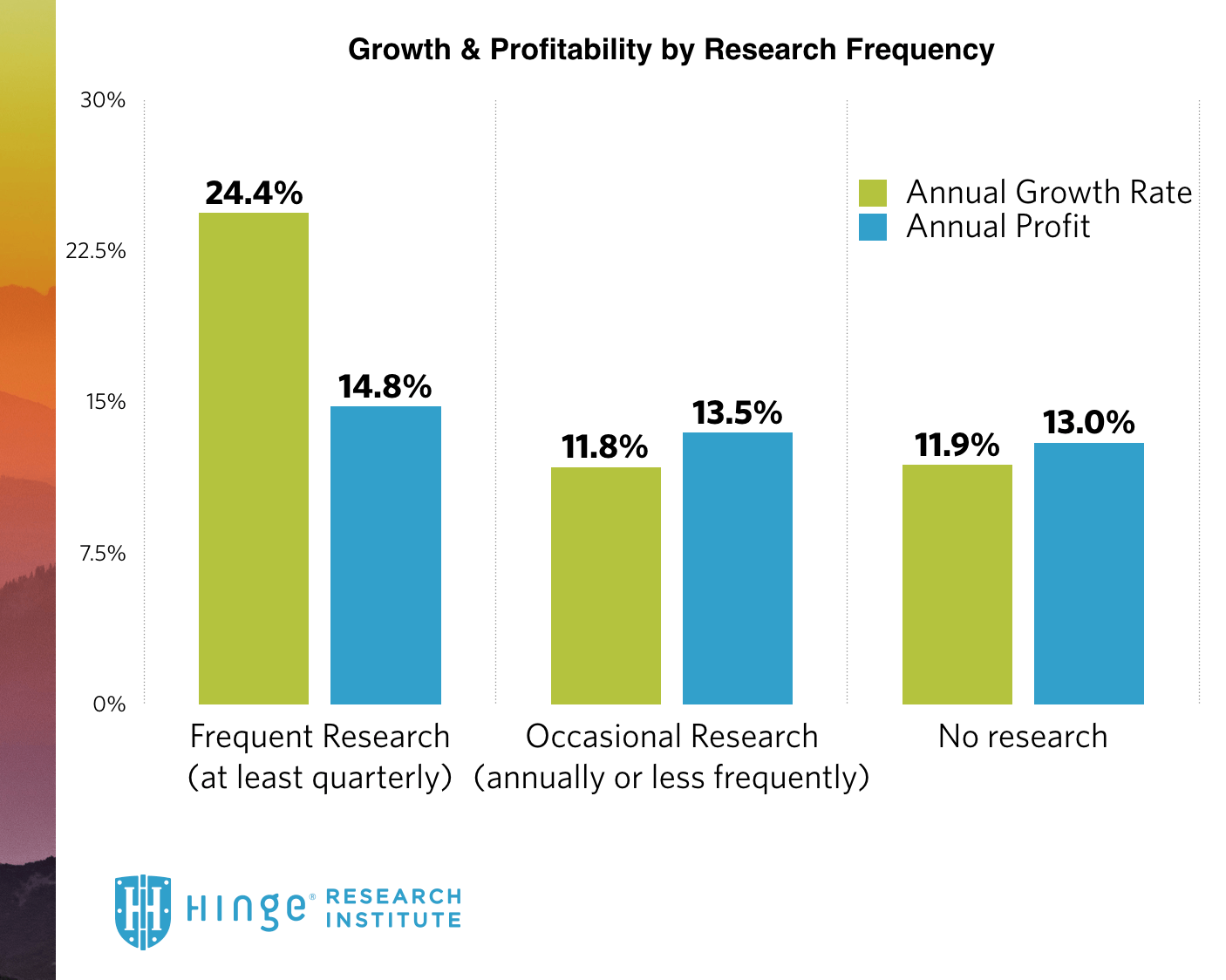

In 2010, the Hinge Research Institute recognized a relationship between growth, profitability and research frequency in the book, Spiraling Up: How to Create a High Growth, High Value Professional Services Firm. A decade later, that same relationship held true. Firms who conducted frequent research (at least quarterly) on their target market tended to grow faster and were slightly more profitable.

There are two ways professional services firms use this kind of research. First, companies use research to inform branding and marketing strategy. Examples of this kind of quarterly research include brand tracking studies, client experience research, and marketplace visibility analyses.

Second, some companies are researching issues and topics that are relevant to their target clients—then publishing that research and using it as high-value marketing content.

Ultimately, doing frequent research reduces firm risk and gives companies the competitive advantage of knowing their audiences better than their competitors. It allows firms to anticipate problems before they happen, which drives faster growth and profitability.

Strategy #3 — Invest in workflow automation

Overall, High-Growth firms worried less about future threats than their No-Growth brethren—with one notable exception: automation.

High Growth firms were nearly 60% more likely to view automation and artificial intelligence (AI) as a challenge for their business to overcome in the next 3 to 5 years. This suggests that High-Growth firms are more likely to embrace technologies that enable workflow automation in the future.

So what kind of technologies can professional services firms benefit from?

On the “Visible Expert” podcast, we interviewed Andrew Filev, CEO of a company called Wrike who created a software category called ‘collaborative work management’ in 2006. His intent is for professional services firms to streamline their project management processes to boost productivity.

Tune to the 6:04 minute mark to hear Andrew talk about how this software can streamline the project management process and boost productivity

We are also collaborating on new research with Bill.com, a software company that uses technology to streamline payment processes. This could be of immense value to accounting firms who wish to leverage technology to give their CPAs more time to focus on offering advisory services to clients.

Deltek, a technology company that helps consulting firms connect and automate the project lifecycle, recently hosted a panel discussion about what it takes to drive growth in today’s marketplace. One way high-growth consulting firms are driving growth is to leverage automation and technology to proactive plan for resource allocation for upcoming projects.

Image Source: John Tyreman on LinkedIn

Strategy #4 — Leverage marketing technology

Heading into 2020, the research showed High-Growth firms were 2x more likely to prioritize marketing technology and automation, effectively doubling down on digital.

Scott Brinker, VP of platform ecosystem at HubSpot and founder of the Martech East and West conferences, shared his thoughts on the future of marketing technology and how the roles of marketers will change in the future. Scott contends that marketing departments may collide with IT functions, creating conflict. Firms would be wise to promote collaboration between marketing and IT to address real impediments to martech success.

Tune to the 6:08 minute mark to hear Scott speak about the challenges firms face when investing in marketing technology

Beyond investing in technology and collaborating with IT departments, companies must consider how this technology will affect their brand and marketing strategies.

With new streamlined and automated processes, marketing systems allow companies to make relevant expertise more visible to their best prospects. This may be one reason why “content creation” has quickly become the top marketing priority of professional services firms in the last three years.

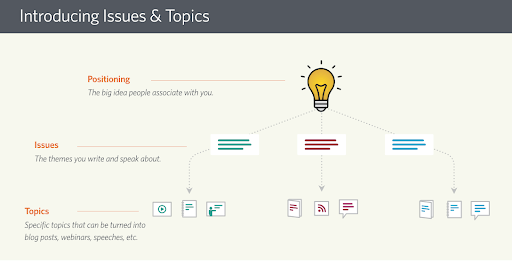

🚨CAUTION 🚨Do not create content for content’s sake.

Good content is focused on topics relating to industry issues.

Good industry issues overlap with your brand’s positioning.

Good brand positioning starts with researching your clients.

High-Growth firms are finding new content channels and formats to make their expertise more appealing, too. The research showed they invested 28% more marketing effort towards publishing primary research, 21% more towards case stories and 30% more towards podcasts.

The investment into high-quality, high-value content paid off. High-Growth firms reported 30% more impact from publishing primary research, 30% more impact from case stories, and a whopping 136% more impact from podcasting.

Strategy #5 — Develop a skills advantage in marketing and sales

The talent war shows no signs of abating. But High-Growth firms are less concerned with threats to their human resources.

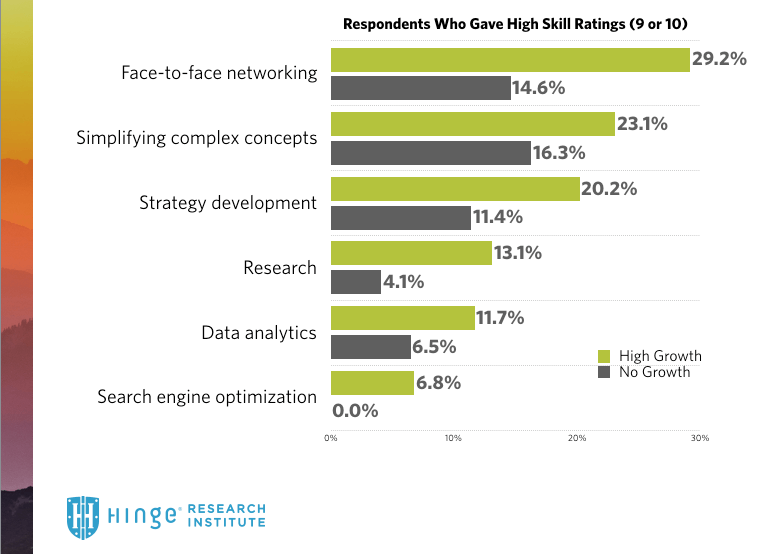

Professional service providers looking to grow rapidly may need to differentiate their employer brands to attract and retain top professionals. This is especially true within marketing departments. As more companies invest in marketing technology, new marketing skills will be in higher demand.

Marketing departments within High Growth firms received higher skill ratings across the board. They were 3x more likely to have highly skilled research teams, 2x more likely to have highly skilled networkers, and 50% more likely to have highly skilled teams doing strategy and data analytics.

Having this skills advantage resulted in stronger marketing impact for these High-Growth firms, who reported more marketing impact from nearly every marketing technique studied. In particular, these High-Growth firms reported 30% more impact from publishing research and 33% more impact from networking on social media — two examples of techniques with positive impact from this skills advantage.

These insights are just the tip of the iceberg…

Our executive summary was derived from a more fulsome report that details the perspectives of over 1,000 professional services organizations with a combined $70 billion in annual revenues. The High Growth Study 2020: All Professional Services Edition is available for purchase through the Hinge Research Institute.

This 80-page report with more than 50 charts, tables and graphs has insights available nowhere else. Here are just some of the things you will find only in the full report:

- Analysis of trends observed in professional services over the past 3-5 years, and what they could mean about the future.

- Worksheets to compare your firm’s financial performance to industry and company size benchmarks of marketing budgets, revenue per employee figures, growth rates, profitability and more.

- Analysis of “digital disruptors” who generate a majority of business leads online.

- Full charts, tables and graphs of research results. Data relates to firm marketing strategies, team skills, digital & content marketing channels, traditional marketing methods, and more.