For many firms, the last two years have been the best of times. For others, they have been the worst of times. No matter where your firm ended up, you need to prepare for the next two years. You need answers to questions. How are our buyers behaving now compared to a couple of years ago? How well do we know our buyers? What are their key business challenges? How do our target audiences find our firm? What do they think of firms like ours in our industry? How do they evaluate firms like ours? How visible is our firm to them? What role does relevancy play in the selection process?

One of the best places to start getting your questions answered is the 4th edition of our pioneering study of professional services buyers and sellers called Inside the Buyer’s Brain.

About the Research

At the Hinge Research Institute, we’ve studied more than 40,000 buyers and sellers–giving us unparalleled insight into the professional services industry.

Our most recent study details the perspectives of more than 1,900 buyers and 3,610 sellers of professional services. We were able to compare results between buyers and sellers across five different groups of firms:

- Accounting & Financial Services

- Architecture, Engineering, & Construction

- Consulting

- Government Contractors

- Technology & Software

Here are four key professional services insights that came out of our latest Inside the Buyer’s Brain data and findings.

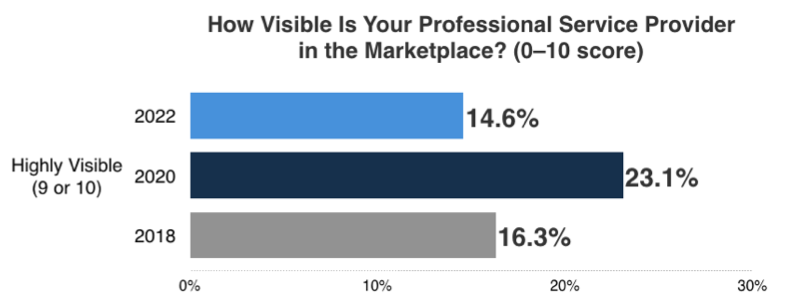

Finding #1: Seller Visibility has Plunged 37% Over the Last Two Years

Our research found that the perception of a highly visible firm fell from 23.1% in 2020 to 14.6% in 2022. How many opportunities is your firm not considered for because prospects do not know who you are?

There is good news. You can increase your firm’s visibility. There are marketing consulting firms such as Hinge that offer programs to help improve visibility such as “The Visible Firm” and “The Visible Expert.” These types of programs not only teach you how to raise visibility for you or your firm, they also show you how to monetize that visibility.

Our research also shows that there is a relationship between relevancy and visibility. Firms that are rated as having high relevancy also rate highly for visibility. Now may be a great time to step back and assess your firm’s expertise, experience, skills, and service offerings to see how well they solve the challenges your target market is facing.

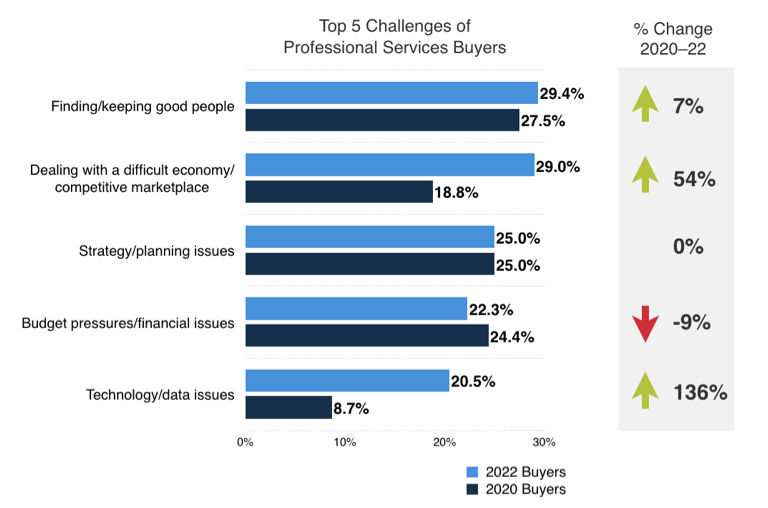

Finding #2: A Difficult Economy and Technology/Data Issues are Growing Buyer Challenges…and Seller Opportunities

As the chart above shows, “Dealing with a difficult economy/competitive marketplace” was the #2 challenge for professional services buyers–rising 54%. “Technology/data issues” broke into the Top 5 Challenges with an upward change of 136% between 2020 and 2022. Here is a great opportunity for your firm to increase its relevancy by providing skills, expertise, or experience that solves technology and data issues. Also, you may want to revisit how you are packaging your services and services terms to be more flexible and accommodating.

A competitive marketplace and technology/data are issues that are not going away any time soon, and many of your prospects do not have the time, budget, or focus to hire all the internal skills and expertise they need. Show them it is in their best interest to rely on your firm for that expertise.

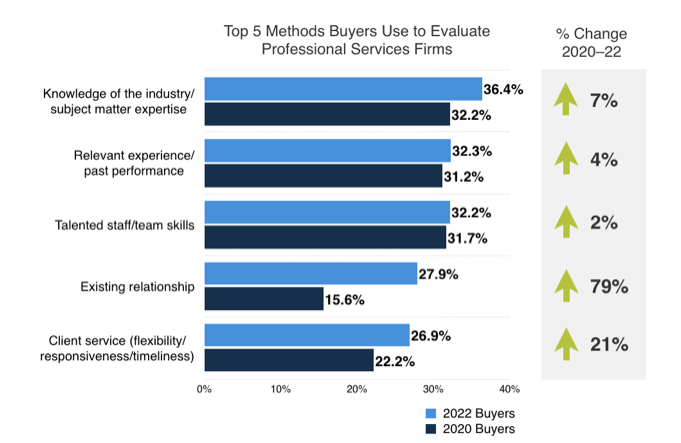

Finding #3: Buyers Highly Value Existing Relationships

Take a look at the chart below.

Having an “existing relationship” with a vendor is now one of the top 5 methods used by buyers to evaluate professional services firms. Not only is it a top evaluation method, but with a positive change of 79%, it is top scale tipper when buyers are trying to make decisions.

Several factors may drive this rise. For instance, clients may be more comfortable working with partners they already know. In addition, continuing an existing relationship may feel less risky. Now is a good time to assess your business development efforts and see if it makes sense to dedicate some more time to building existing relationships versus pursuing new business.

Finding #4: Surprise! Buyers May Not Be Learning About Products and Services Through Social Media

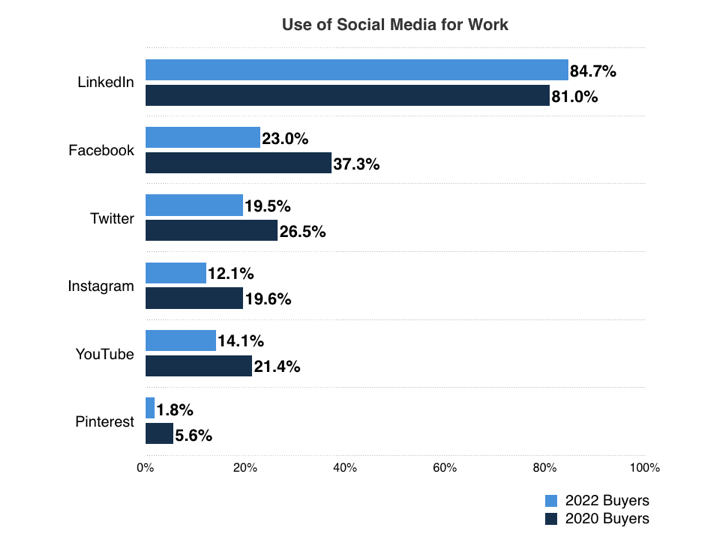

Sellers are always looking for the best ways to reach, educate, and influence their target audiences. Many would assume that social media would be a primary channel to achieve this goal. We were a bit surprised when we saw the following data in our latest version of Inside the Buyer’s Brain.

Almost all the social media platforms declined in usage from 2020 to 2022. The only platform where engagement rose was LinkedIn.

This research shows that while social media can round out your marketing and business development strategies, you should not consider it the primary channel to generate visibility, leads, or engagement.

If your team is going to dedicate time to social media, be very selective. As our research shows, most buyers are only using LinkedIn for business. There is a lot you can do with LinkedIn. Try going deep in this channel until you master it.

A Few Final Thoughts

Professional services buyer behavior will continue to change in the face of today’s–tomorrow’s–frequent disruptions. The best way for your firm to stay relevant is by starting with research on your target audiences to understand their challenges and needs, where they look for information, and how they evaluate service providers. This type of research will validate–or challenge–your assumptions and decisions. Research, such as Inside the Buyer’s Brain, should show your firm how to deliver more value than your competitors.

How Hinge Can Help

To learn more of the findings from our Inside the Buyer’s Brain research, be sure to download the free Inside the Buyer’s Brain Executive Summary. You may also want to consider purchasing the full Inside the Buyer’s Brain study (available in five industry editions) or license a full study so that you can use the content in your marketing campaigns over the next 12 months. Contact the Hinge Research Institute for more details.