The answer depends on whom you ask.

Maybe your firm manages software implementations, builds custom apps, sources executive talent, or acquires investor funding. Whatever type of technology firm you are, your services are undoubtedly valuable.

But does your firm fully understand how and why your services are relevant to a client’s business? Or how the problem you solve ranks among other issues clients face — sure, you’re good at solving certain problems, but are you solving what your buyers think of as their main problem?

Most firms struggle to answer these questions, and that got us thinking.

What critical business challenges are clients and prospects trying to solve that leads them to seek out a professional services provider in the first place? And how closely does the value those clients and prospects see in their relationship with their professional services provider align with what providers think their clients and prospects value?

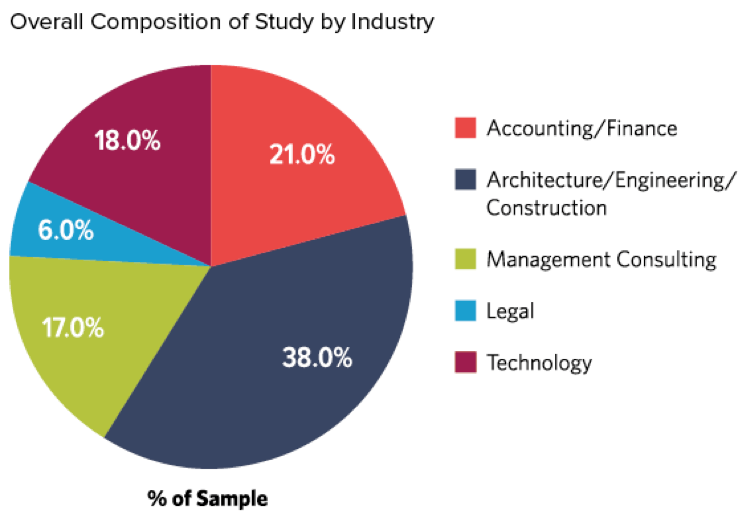

To find out, we interviewed 1500 buyers and sellers of services across five verticals in order to identify critical areas where professional service providers (the sellers) and their clients and prospects (the buyers) might not see things the same way.

Where does it hurt?

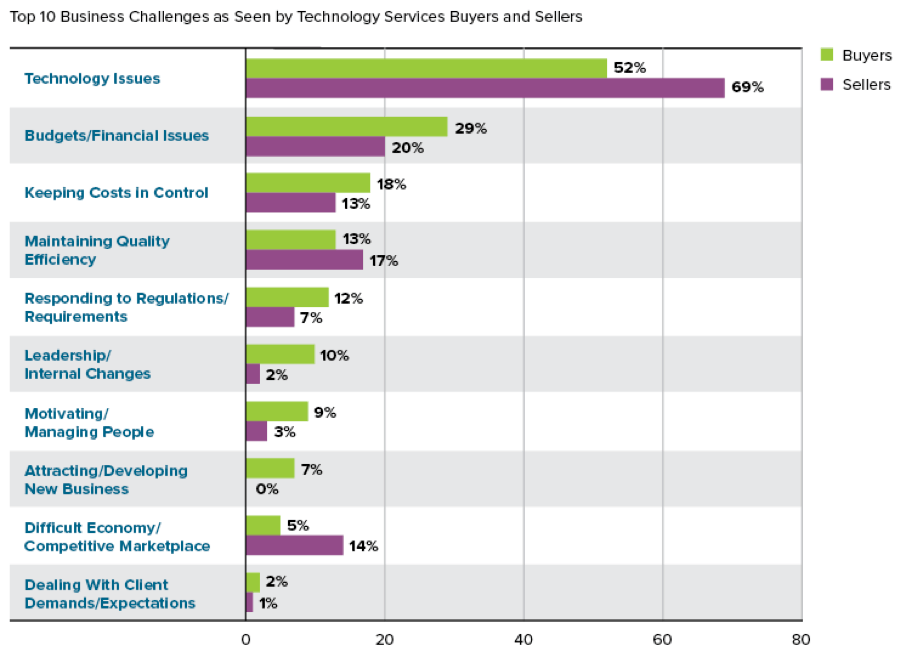

To start, we asked buyers and sellers to identify the most significant business challenges buyers face. Here is a snapshot of how buyers and sellers in the technology services market answered:

The good news — sellers of technology services seem to be much more in tune with key business challenges of their buyers. Technology issues were overwhelmingly the most common challenge listed by buyers, and sellers demonstrated a keen awareness for this. The fact that tech issues made the top of the list isn’t surprising. The rapidity at which technology changes and evolves can be difficult for firms to manage, making strategic planning and long term goal setting feel like a moving target.

The data showed much bigger perception gaps between buyers and sellers in other professional services verticals on the topic of key challenges. Buyers in other verticals mentioned dealing with a difficult economy and competitive marketplace as their top challenges and service providers underestimated this to a large extent. But it’s interesting to note that while buyers of technology services mentioned the economy and the competitive marketplace way down on their list of concerns, sellers thought this variable had much more prominence in the eyes of their buyers, listing it fourth (this was an open ended question by the way, where respondents were able to say anything they wanted).

This begs the question: if you misjudge your clients’ challenges, how can you be sure your services, or the way you talk about your services, are really important to them?

The answer of course lies in truly understanding your prospects and clients. This goes far beyond customer satisfaction surveys, which serve a very particular purpose. Conducting primary research can lay the foundation for understanding your clients’ and prospects’ challenges and emerging issues, putting you far ahead of the competition. Moreover, it is a direct and customized approach to marketing, answering specific questions you have about an identified group. Your clients can tell you a host of information about your firm if you ask. Prospects are tougher to reach, but not impossible.

Still not sure if research is for you? Let us break it down for you.

Your clients find your services far less important than you do

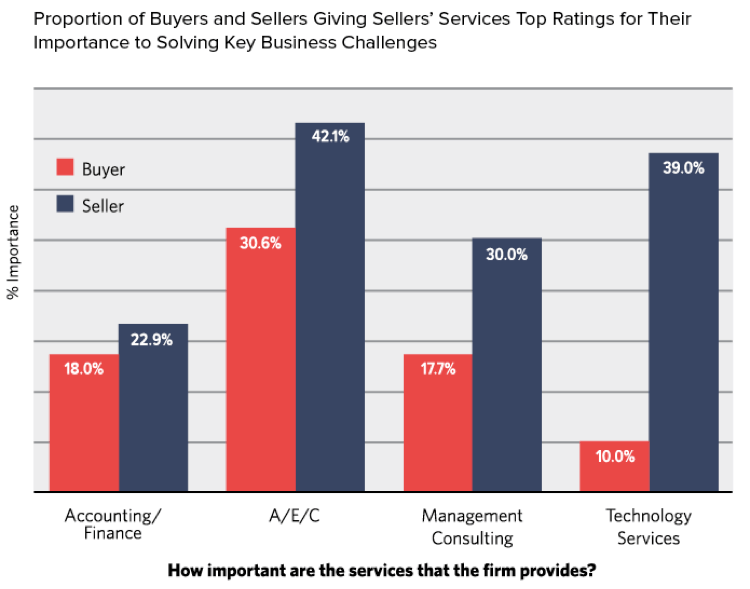

Painful medicine, we know. We asked buyers to rate the importance of the sellers’ services to solving their challenges. The table above shows the proportion of buyers and sellers giving the seller’s services top importance ratings.

The biggest value perception gap is found between professional services firms in the technology marketplace and their clients. Comparatively, architecture, engineering, and construction firms’ services are perceived as more relevant to solving the key issues clients face. This would seem counterintuitive – most providers of tech services would probably say that they can address “technology challenges”, as broad as that is, in general. So the fact that only 10% of tech services buyers find the services their service providers offer to be very important in terms of solving their key challenges is disconcerting at best. What can that possibly mean?

A sharper image

Remember, CEOs, directors, and other decision makers are listening to how you talk about your firm and the challenges you solve. The service you provide, and indeed the knowledge you bring to the table, may very well help your clients navigate through the challenges technology adoption brings to the fore. But are you messaging around that challenge, or are you perhaps positioning your services with some other angle, such as cost effectiveness, best in the industry, or something else off target? You lose credibility when your claims do not jive with their reality.

More good news: these divergent points of view present a great opportunity for technology providers in particular. With further research integrated into a professional service firm’s marketing plan, there is a tremendous opportunity to meet buyers’ expectations. Technology providers can use that research to find out how their buyers perceive them, and how to tap into their buyers’ needs in order to successfully close the value perception gap and forge long-lasting mutually beneficial business relationships.

Find out more about the perception gaps between buyers and sellers of technology services, what motivates prospects, and what mistakes to avoid in order to give your firm leverage in the marketplace in our research study, How Buyers Buy Technology Services.

On Twitter or LinkedIn? Follow us @hingemarketing and join us on LinkedIn.