The Hinge Research Institute is releasing a special accounting and financial services industry version of its breakthrough study of professional services buyers and the firms that they hire. It’s called Inside the Buyer’s Brain: Accounting and Financial Services Edition.

Why This Study is Needed

Accounting and financial services firms (A&FS) are undergoing an extended period of flux. Clients are changing the way they educate themselves and how they look for and evaluate professional services providers. The traditional approaches are becoming less and less effective in today’s rapidly changing environment.

On top of these long-term trends, add a global pandemic and a rapidly changing regulatory environment and it is easy to see the stress and uncertainty that many A&FS firms experience.

Fortunately, there is a way to cut through some of this uncertainty and gain some real insight into what your buyers think today and where the trends are likely to take us in the future.

About the Study

The original study was published in 2013 and provided the first comprehensive look at the differing perspectives of buyers and sellers throughout the entire professional services buyers’ journey.

A second version of the study was published in 2018. This study revealed a rapidly evolving landscape that presented new challenges and opportunities.

The pace and scope of change was so profound that we decided to follow-up with the current study just two years later in 2020. This study also saw the addition of industry specific versions of the report, such as this one.

The timing could not have been better. It allowed us to capture the first real indication of the emerging buyer concerns and preferences.

Focused on Accounting and Financial Services

In the current report we are focusing on accounting and financial services firms. We explore the challenges their clients are facing and the role they see their provider play. We also explore the new client journey from their first exploration of a business challenge to the final selection of the firm they choose to work with.

We then look at the client experience and how it does or doesn’t translate into an ongoing relationship and referrals. To put the findings in perspective we compare key A&FS results to other professional services verticals such as Consulting and Technology & Software.

Sampled Both Buyers and Sellers

Using phone interviews and online surveys, we researched more than 1,021 buyers and 384 sellers of accounting and financial services. Because the buyers bought services from the sellers, we were able to study both sides of the relationship and how they see each other and identify disconnects that can derail a professional relationship.

Cross Industry Comparisons Included

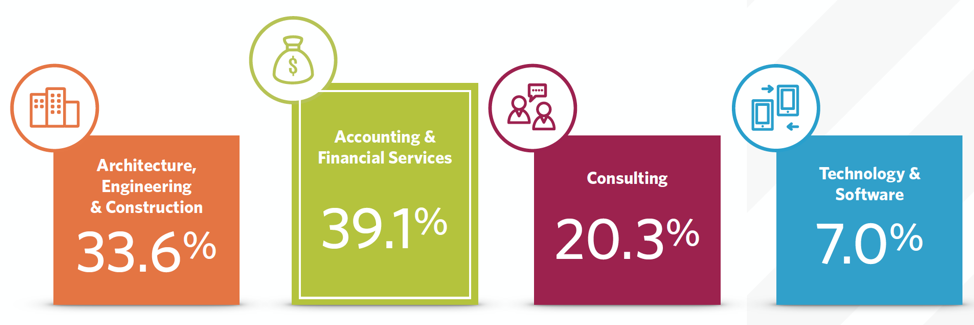

In addition to reporting on the industry data, we also looked at the findings from other angles. This report examines the responses from Accounting & Financial Services firms and puts them in the context of three other major professional services groups:

The results of the study are organized around four questions that capture the most impactful steps in an A&FS buyers’ journey.

What Are the Buyers’ Business Challenges?

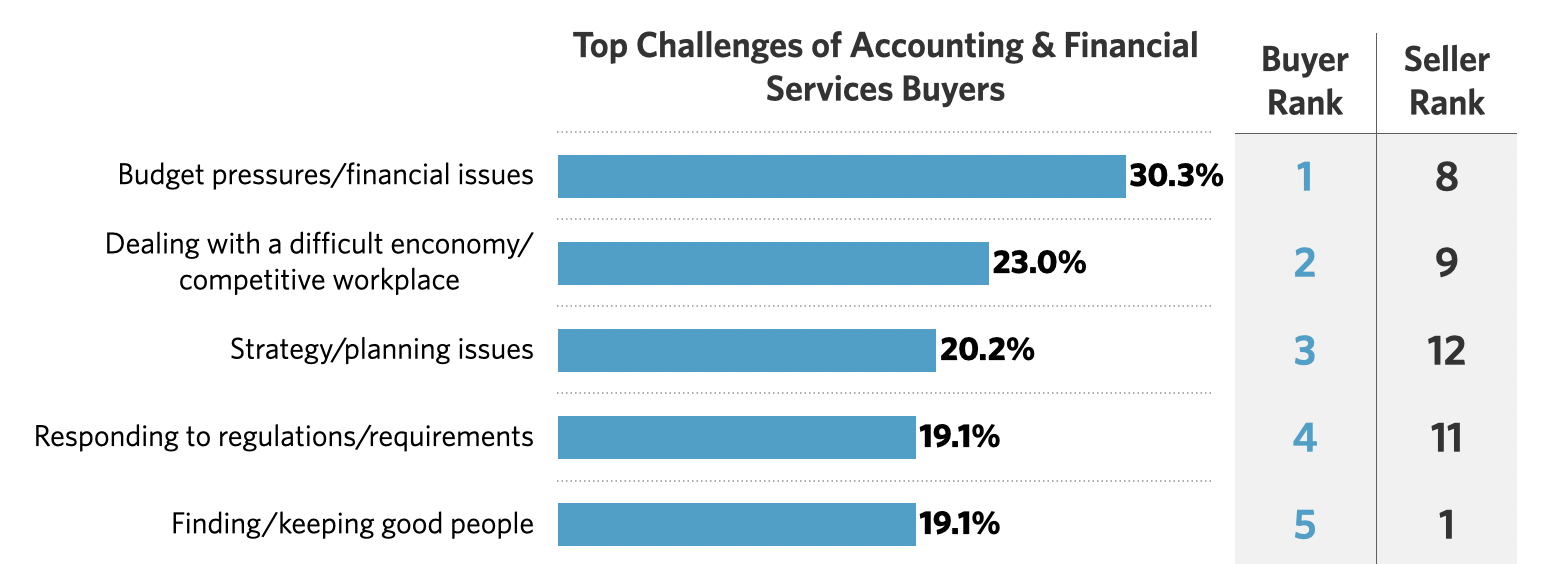

Most professionals believe they understand the challenges their potential clients face. This data demonstrates the fallacy of that belief.

Only one of the buyer’s top five challenges were correctly identified by A&FS sellers. Of particular note are strategy/planning issues and responding to regulatory requirements. Most A&FS firms are well aligned with at least one of these. Yet neither made seller’s top ten list of buyer challenges.

Professionals in A&FS firms have some significant disconnects when it comes to understanding the top challenges of their clients. It is hard to be relevant to buyer concerns if you do not understand what they are. And as we shall soon see, that miss can have a major impact on your firm.

How Do Clients Feel About Their Service Providers?

Most A&FS buyers (68.3%) would gladly recommend their current provider to a friend or colleague. But fewer and fewer friends and colleagues are bothering to ask. It’s quicker and easier to do a web search or check on social media. Even more troubling is the erosion of client’s willingness to recommend, down by an alarming 15% in just two years.

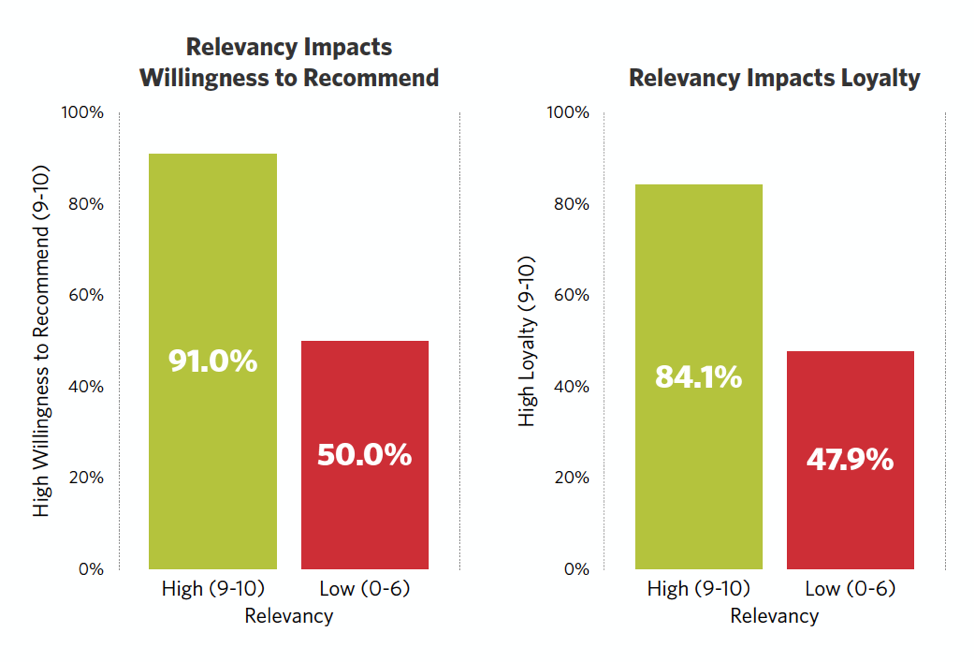

Despite a 25% incremental improvement, A&FS firms are still seen as the least relevant to buyers’ most important challenges of all the professional services studied. This is significant as relevance impacts both willingness to recommend and client loyalty.

High-level relevance to the prospects’ key issues not only wins new clients, it also helps you keep them. Firms that are viewed as highly relevant to clients’ current issues are 82% more likely to be highly recommended by their existing clients. High relevancy ratings are also associated with a 76% higher likelihood of having highly loyal clients.

How Do Buyers Search for Service Providers?

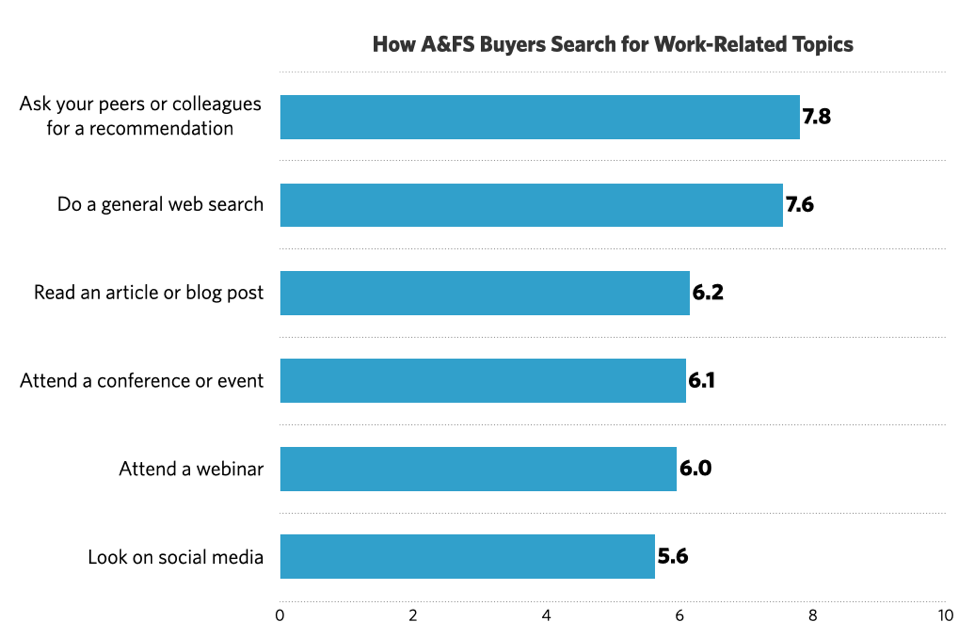

A&FS buyers have traditionally turned to a friend or colleague when investigating business related issues. No longer. Web searches are now on a virtual tie with asking a colleague for help.

Similarly, webinars are now on a par with conferences and events as information sources.

LinkedIn is used by over 77% of buyers, making it the dominant social media platform.

Facebook is making a surprisingly strong showing with a third of A&FS buyers using it for business purposes.

A&FS firm visibility is nearly on par with the other industries. Visibility growth for A&FS firms is substantially less than for consulting (160%) and tech/software (81%). If present trends continue, A&FS firms could easily fall behind their consulting and technology/software competitors in terms of market visibility.

How Do Buyers Evaluate Service Providers?

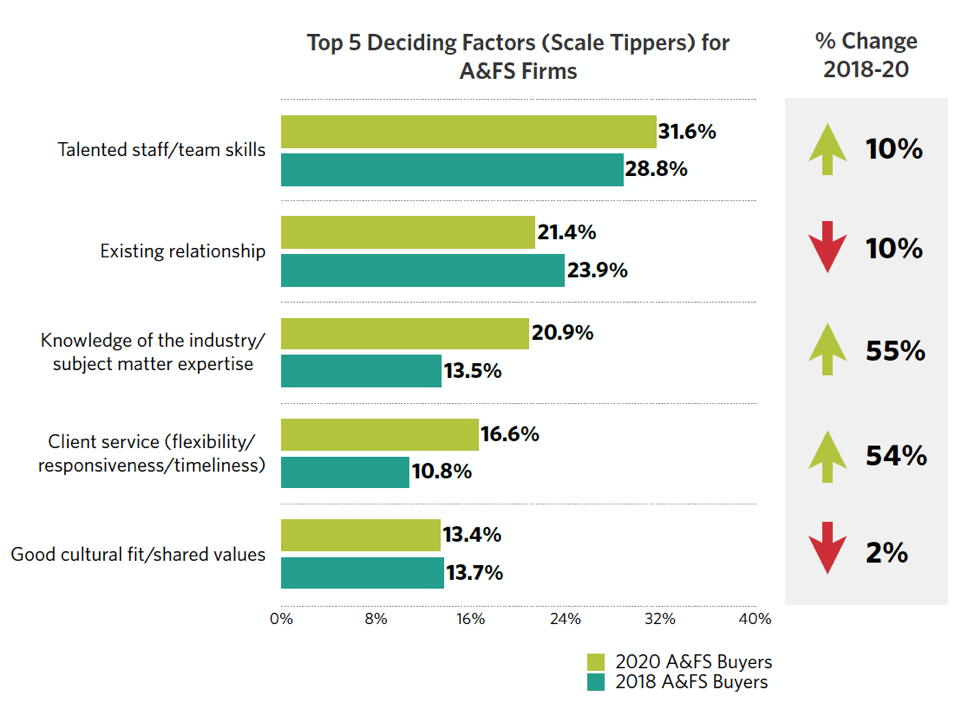

While nurturing existing relationships has long been foundational in many A&FS firms, we are seeing the limits of this strategy. Clients are less likely to stay with an existing firm, especially if a competitor has deeper industry knowledge and a more talented staff with greater subject matter expertise.

Talented staff/team skills are now the top deciding factor for almost one-third of Buyers. Industry knowledge and flexible and responsive client service are also becoming much more important in closing the A&FS sale.

What Does This Mean for Your Firm?

The A&FS industry is undergoing a period of significant and rapid change. While no one can know for sure how this change will play out, some conclusions seem clear.

Sellers have some dangerous blind spots when it comes to understanding their buyers. While we may feel that we really understand our clients and their challenges, the data paints a different picture. There are blind spots around key insights that will cost you new business unless you have accurate information. This is especially true during this period of rapid change. The solution is regular research on your target audience, such as the current study.

It’s time to get serious about digital. Consumers and clients have been migrating to digital communications channels for many years. We have seen digital approach and overtake traditional marketing and delivery channels. And with the widespread “remote work” experience that so many have shared, the time has come to act. Buyers are free to search for the specific expertise they need, independent of geographic location. Don’t get left behind waiting for things to “get back to normal”.

Focus on the relevance of your services. Making your expertise visible is important, but don’t forget to make it relevant to the buyer’s challenges as well. Don’t assume that your potential client understands what they need or how you can help them, even if it seems obvious to you.

Part of your job is connecting the dots between the buyer’s challenge and your solution. And don’t forget to reinforce that relevance on a regular basis. If not, you can easily get taken for granted over time.

Changes in buyer behavior are reducing the impact of traditional approaches. Buyers are changing their behavior at a fast clip. Many traditional A&FS business development strategies no longer work as well as they used to. They do what is quicker and easier. Buyers search online rather that asking a friend for a referral. They are less loyal and more inclined to find a best fit solution, rather than fall back on existing relationships. Don’t make the assumption that what worked before will work again.

People still matter. People are still important. Recruiting and retaining talented staff remains important to long term success. Buyers want to work with experts who can help them meet their challenges. Visible expertise closes deals. Human connection and trust still matter. The difference is that these interactions do not need to be face to face in order to be rewarding and successful.