As we were analyzing the data from our 2024 High Growth Study, we noticed that one growth strategy in particular stood out. The High Growth firms—firms that grow 20% or more annually over a three-year period—were particularly likely to participate in a merger or acquisition (M&A). Professional services firms have long used strategic acquisitions to enter new markets and deepen their portfolio of services, but the trend seemed particularly strong this year.

In 2023, the year our data was collected, 43.9% of respondents in the High Growth category reported that their firms engaged in a merger or acquisition. That was an impressive number, especially given that the Fed raised interest rates last year, increasing the cost of capital.

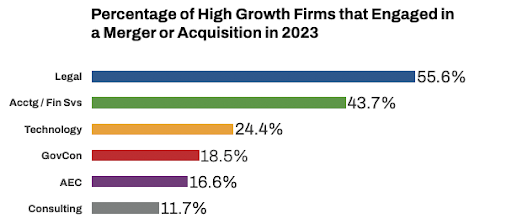

I decided to dig a little deeper and see whether this M&A trend applied equally across the spectrum of professional services. As it turns out, there is a lot of variance, with most of the activity coming from just two industries: legal and accounting & financial services.

Why those two industries? Despite the market friction I describe above, there’s been a lot of recent private equity (PE) interest in the accounting industry, as evidenced by PE investments in market leaders such as Grant Thornton and Baker Tilly.

Some investors believe this historically conservative industry is ripe for transformation—through technologies like AI and automation and disruptive new business models. They also see a highly fragmented marketplace with opportunities to create efficiencies through consolidation.

Law firms offer similar opportunities, and according to a recent article in Forbes, they could be the next big PE target. And according to legal consultancy Fairfax Associates, M&A activity has increased in the first first quarter of this year by 25%.

Perhaps more than other industries, accounting and law firms can have an easier time assimilating acquisitions into their organizations. That’s because both kinds of businesses are made up of experts who have been educated in similar ways, and firms across the nation usually deliver their services using similar business models. These two industries also offer portfolios of long-term, loyal clients and a track record of positive cash flow. That makes them attractive to buyers.

Of course, M&A is a common strategy in other professional services industries, as well. However, in 2023 at least, their M&A activity was more muted. Last year, for instance, about a quarter of High Growth technology firms underwent a merger or acquisition. And at the bottom end, the best performing consulting firms did so at a tepid 11.7% rate.

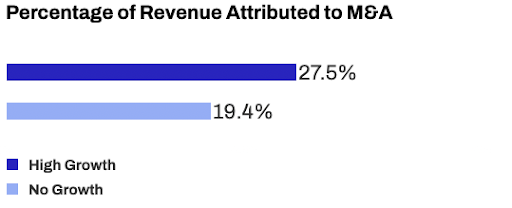

Of those firms that engaged in M&A, they attributed a significant portion of their revenue to it. Here’s how the High Growth firms compared to their No Growth peers:

Why do High Growth firms achieve better results? While the data doesn’t answer this question, there are likely a variety of reasons. They may simply be more experienced, having acquired many practices over the years. They may have a better, clear-eyed M&A process. And they may be better at measuring the success of each acquisition—and doing what’s required to assimilate new personnel into the firm’s culture.

Should you consider an M&A growth strategy at your firm? For the uninitiated, it can be a challenging undertaking, especially if you are trying to combine two very different organizations and cultures. But if your goal is to enter a new market where you have no visibility, or if you need to acquire specific expertise in a tight labor market, an acquisition may be the easiest path forward.

How Hinge Can Help

Hinge, a global leader in professional services branding and marketing, helps firms grow faster and become more profitable. We offer a comprehensive suite of research, marketing and strategy services. Our research-based strategies are designed to be practical for firms of any size. And our groundbreaking Visible Firm program combines research, strategy, implementation, training and more.