Today, Hinge is excited to announce the release of a new study on professional services buyer behavior. This study conducted by the Hinge Research Institute provides insight into how professional services firms can win new business and grow faster by better understanding their buyers.

Buyers of professional services today have changed significantly in the last few years. As they face new challenges in the marketplace and try new ways to find and vet service providers, buyers’ criteria for evaluating potential vendors has evolved. If you want to stand out in an increasingly competitive marketplace, it’s critical to understand target client behavior and tendencies.

In this post, we’ll explore some key takeaways from this research and how they fit into our understanding of the professional services marketplace.

About the research

This study has deep roots. For the past decade, we’ve been working hard to understand professional services buyers:

- In 2009, we published our original buyer study in which we interviewed 137 buyers of professional services.

- In 2013, we published Inside the Buyer’s Brain: How to Turn Buyers into Believers, a book based on a new study of 822 buyers and 533 sellers of professional services.

- And now in 2018, we’ve released this study: Inside the Buyer’s Brain: Understand your buyers. Win more business. It details the perspectives of 1,475 buyers and 3,005 sellers in a changing marketplace.

We matched buyers to their respective sellers, which allowed us to study both sides of the relationship.

We matched buyers to their respective sellers, which allowed us to study both sides of the relationship.

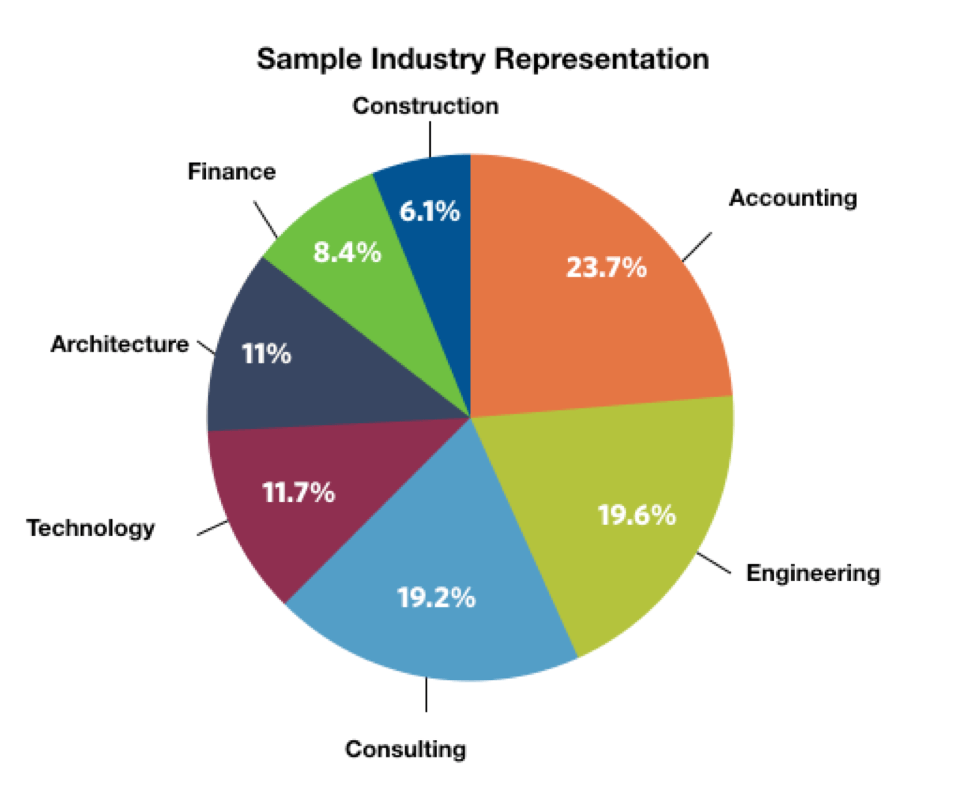

A broad mix of professional services were represented in the sample. Many firms we studied also sell to government buyers, who made up 35% of our buyer sample.

We noticed many differences between industries and among government buyers. Those detailed breakdowns can be found in the full report.

Key findings

1.) Relying on referrals alone is becoming a risky marketing strategy.

Even though buyers today believe themselves to be more likely to refer, the rate at which they actually make a referral is down slightly from 74% in 2013.

Even though buyers today believe themselves to be more likely to refer, the rate at which they actually make a referral is down slightly from 74% in 2013.

One possible reason for this decline is that is that more and more buyers are searching for service providers in other ways. In 2013, more than 70% of buyers reported turning to their network when they needed a new service provider. While referrals remain the top search method, less than 60% of today’s buyers ask for referrals — a 15% decrease.

At the same time, web search is becoming an increasingly popular tool, with nearly 1 in 5 buyers turning to search engines to find service providers. Soon, Google could be the top referral source for professional services.

>> Get the FREE executive summary

2.) Buyers are placing a higher importance on expertise in the selection process.

Relevant experience and expertise are the top criteria buyers use to evaluate potential service providers. This has changed since 2013, when we found a good general marketplace reputation, price and cultural fit to be the top three selection criteria.

This suggests that if firms are able to successfully differentiate themselves around subject matter expertise they have a better chance of getting on a short list of finalists.

>> Get the FREE executive summary

3.) Buyers see professional service providers as more relevant and valuable today

In 2013, 19% of buyers viewed their service provider as highly important to solving their challenges. Today, that number jumped to more than 29% — more than a 50% increase. Similarly, buyers are 33% more likely to view their service providers as highly valuable today (68.6%) than five years ago (51.4%).

More buyers believe their service provider is highly relevant to solving their challenges and more buyers see their vendor’s services as highly valuable. These are strong indicators that even in a crowded, competitive marketplace, demand is strong.

>> Get the FREE executive summary

4.) Increased competition is eroding brand strength.

We know from our 2018 High Growth Study that increased competition from both larger and smaller competitors is a top challenge facing professional services firms today. From the buyer’s perspective, more vendors means more leverage in negotiating price. From the seller’s perspective, this commoditization makes it difficult to differentiate their firm and sustain high margins.

The impact of this hyper-competitive environment is clear. Average brand strength among professional services firms dropped nearly 10% in the last five years, driven primarily by a 25% decrease in firm visibility.

In past research, we found increasing firm visibility to be the top marketing priority of professional services firms — a goal that may be easier to set than achieve.

>> Get the FREE executive summary

5.) While competition is fierce, firms still don’t know whom they compete against.

Buyers and sellers of professional services differ in whom they view as competitors. On average, there is only a 30.1% overlap in identified competitors — up from 25% in 2013.

This overlap varies by industry. Consulting firms saw the stiffest competition, with the average firm able to identify only 23% of competitors. Meanwhile, accounting and financial services firms correctly identified 37% of their competitors.

In prior studies, we found that researching the competition was a top marketing priority of professional services firms. Firms that invest in understanding the marketplace can more easily pivot and position themselves to address emerging needs before their less-well-informed competitors can adjust.

>> Get the FREE executive summary