From a lingering pandemic and economic turmoil to supply chain issues and political unrest, the past few years have seen an influx of challenges that affect how buyers of AEC services spend their money. For AEC firms to thrive in this transformed marketplace, they need to understand these changes in buyer behavior. What are their biggest obstacles today? How has the way they evaluate service providers evolved? And what tips the scale when they select one firm over another?

How do you make sense of it all?

To help you understand and navigate the new landscape, the Hinge Research Institute has released its 4th edition of Inside the Buyer’s Brain: AEC Industry.

About the Research

Inside the Buyer’s Brain, was first published in 2013, in 2018, and again in 2020, providing the first comprehensive look at the differing perspectives of buyers and sellers of professional services.

Our just-released 4th edition details the perspectives of almost 300 buyers and more than 1,400 sellers of AEC services. In this article, I’ll highlight some of the most pertinent findings from this year’s study.

Finding 1: Recruiting and retention and dealing with a difficult economy are top challenges facing the AEC industry

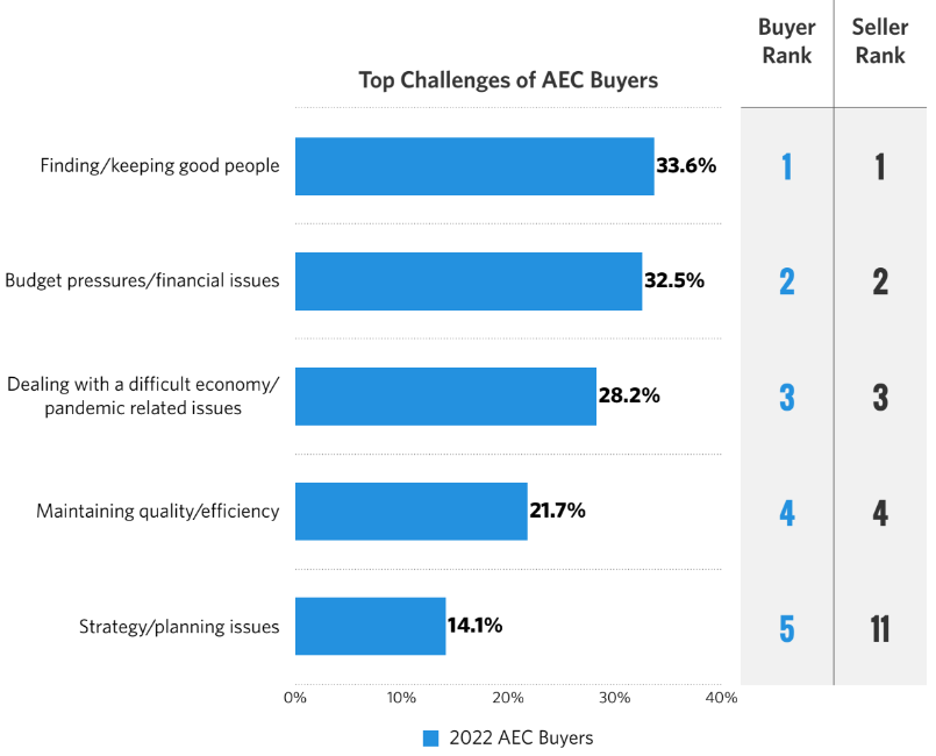

The war for top talent rages on. “Finding/keeping good people” was identified as the top business challenge in 2022, followed by “budget pressures and financial issues.” Buyers of AEC services are struggling to find and hire the talent they need. Keeping that in mind, AEC firms should consider providing the skills their prospects need—to fill any gaps where their services line up with their clients’ needs.

And as economic uncertainty continues, it’s no surprise that “dealing with a difficult economy” has risen dramatically—by 82%—in the last two years.

In fact, AEC buyers and their service providers identified many of the same top challenges, likely because they are dealing with the same ones. However, buyers’ fifth greatest challenge—“strategy/planning issues”—was barely on sellers’ radars, a signal that today’s buyers could be looking for more high-value, strategic services to address recruiting, budget and supply chain issues.

Finding 2: AEC buyers are much more likely to listen to an expert speak on a topic or attend a webinar.

This year, the AEC industry saw an important shift in the way buyers search for information on business-related topics. While “asking your peers for a recommendation” or “doing a web search” will always be primary search methods, AEC buyers are now much more likely to “listen to an expert speak on a topic” compared to two years ago, when the method ranked in last place. Buyers are also more likely to attend a webinar.

To address these new behaviors, AEC firms should consider reallocating some resources to developing their thought leadership. This could include public speaking, writing educational blog posts, conducting webinars and improving their search engine optimization.

This year’s study also saw a sharp decline in the use of social media to search for a business-related topic. But take that insight with a grain of salt. At the same time, AEC buyers are using LinkedIn for business more than ever.

Finding 3: Relevancy ratings are at an all-time high.

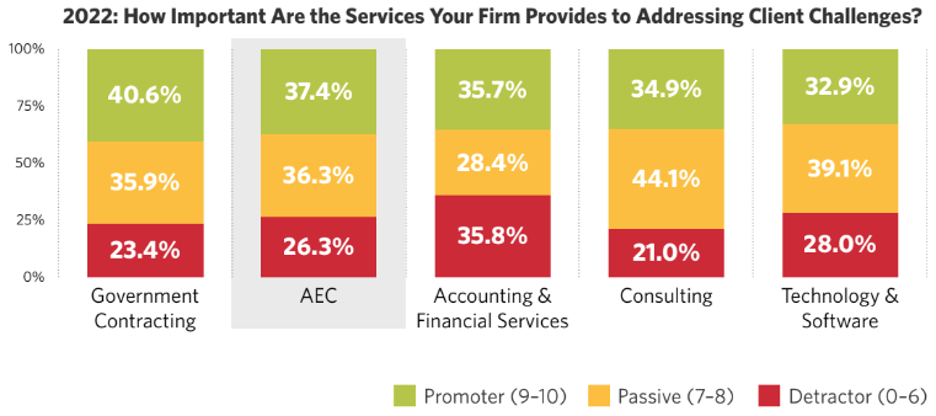

The extent to which AEC firms are addressing their buyers’ top challenges has been steadily increasing since 2018. If you’ve been following this data over the years, you might recall that historically the AEC industry has lagged other professional services industries in this critical area. The steady increase indicates that AEC firms may be doing a better job of understanding their buyers’ needs.

And while relevancy is going to fluctuate depending on buyers’ needs and market conditions, now is a great time to step back and assess the challenges your buyers are facing and determine which ones your firm can address.

Finding 4: AEC buyers’ willingness to recommend their service providers has reached an all-time high, too.

Buyers appear to be more comfortable than ever sharing their client satisfaction with their peers. Not convinced? This year, “client service” joined the top 5 scale tippers for buyers when selecting a services provider. As a result, you may want to put more of your business development resources into expanding existing relationships.

Sellers clearly have the opportunity to provide a better client experience, which can lead to more work, more referrals, and better reputation ratings. If you keep abreast of your buyers’ changing challenges and expectations—and make the appropriate adjustments—you can position your firm to deliver long-term value.

Conclusion

It’s clear AEC buyer behavior has changed, with relevance and willingness to recommend at all-time highs. One way to better understand the nuances of your marketplace is to research your target audiences.

To dive deeper into this data and get more practical advice on applying it to your business, purchase Inside the Buyer’s Brain, 4th Edition: AEC .

Research Report

Inside the Buyer’s Brain, Architecture, Engineering, and Construction Edition

Download NowHow Hinge Can Help

To learn more of the findings from our Inside the Buyer’s Brain research, be sure to download the free Inside the Buyer’s Brain Executive Summary. You may also want to consider purchasing the full Inside the Buyer’s Brain study (available in five industry editions) or license a full study so that you can use the content in your marketing campaigns over the next 12 months. Contact the Hinge Research Institute for more details.